Borrowers Cheer, But Savers Face a Setback as Deposit Rates Likely to Fall

In a surprise move, the Reserve Bank of India (RBI) has announced a significant 50 basis points (bps) cut in the repo rate, bringing it down to 5.50% during its June 2025 Monetary Policy Committee (MPC) meeting. This marks the third consecutive rate cut since February 2025, aimed at accelerating economic growth amid easing inflation.

Alongside the repo rate cut, the central bank has also slashed the Cash Reserve Ratio (CRR) by 100 bps to 3%, unlocking approximately ₹2.5 lakh crore worth of lendable funds for the banking system.

Why Did RBI Cut the Repo Rate?

The primary factor behind the aggressive rate cut is the continued moderation in retail inflation. Headline CPI inflation dropped to 3.2% in April, its lowest level since July 2019, down from 3.3% in March. The decline has largely been driven by falling food prices.

With inflation remaining consistently below the RBI’s 4% target over the past three months, the central bank has found room to ease monetary policy without jeopardizing price stability. Under the Flexible Inflation Targeting (FIT) framework, the RBI aims to maintain CPI at 4%, with a tolerance band of ±2%.

RBI Governor Sanjay Malhotra stated, “With core inflation expected to remain benign, frontloading the rate cut is imperative to support growth amid global uncertainties and tariff-related pressures.”

Impact on Borrowers and Savers

The rate cut will come as welcome news for borrowers, especially those with home or personal loans linked to external benchmark lending rates (EBLR). Loan EMIs are expected to fall by approximately ₹800–₹1,200 per ₹1 lakh of loan, depending on the loan tenure and bank’s pass-through mechanism.

However, the move will likely hurt savers and depositors. Banks are expected to reduce deposit interest rates to align with falling lending rates. Savings accounts already yield historically low returns — some as low as 2.7% — and may face further reductions.

Bond Markets React Positively

Bond markets are expected to rally as lower interest rates drive up bond prices and reduce yields. Government securities, in particular, are likely to see increased investor demand, offering capital gains to existing bondholders and enhancing overall returns on fixed-income portfolios.

Economic Forecasts: Growth Holds, Inflation Revised Downward

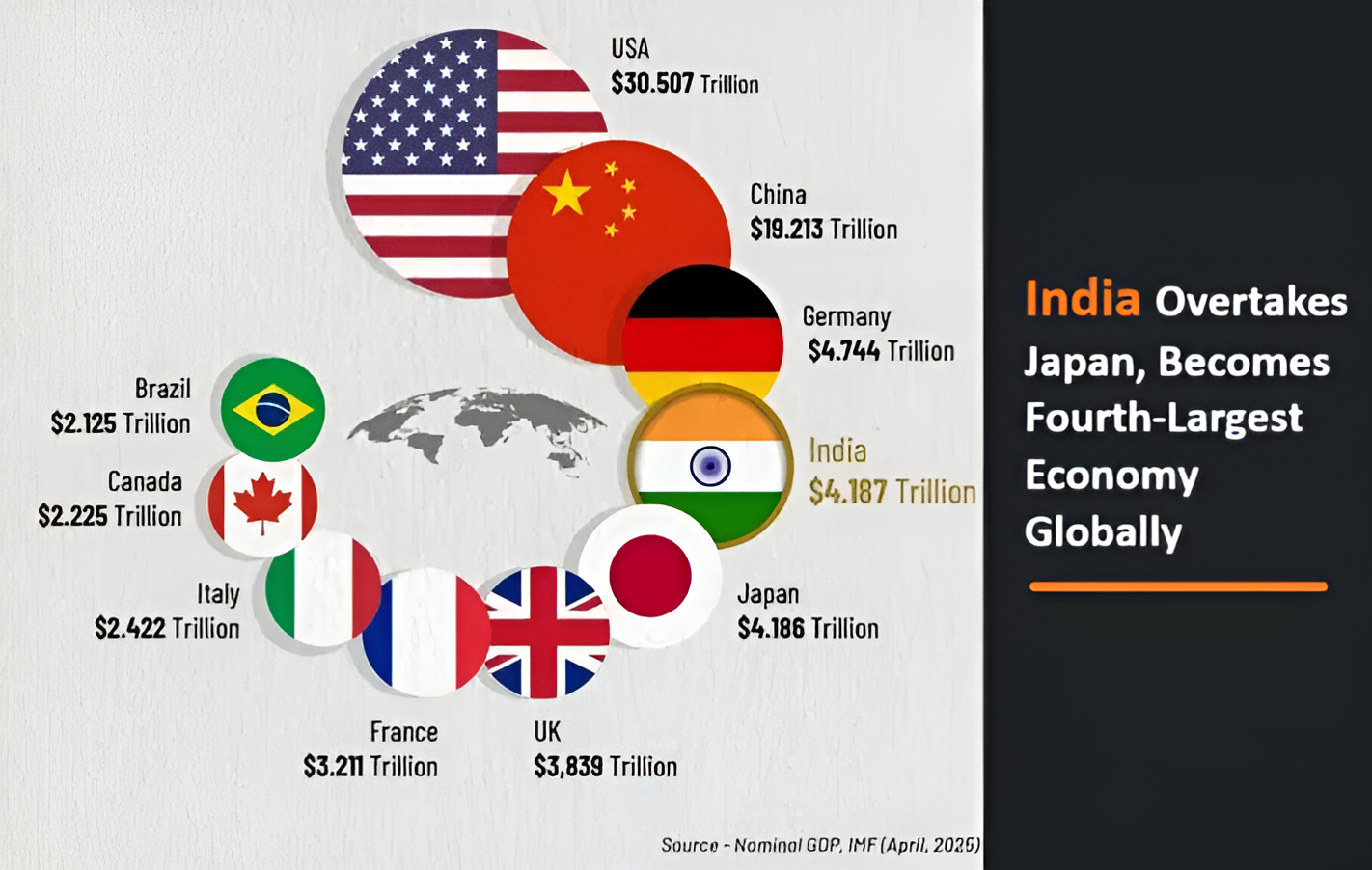

The RBI retained its real GDP growth projection at 6.5% for FY2025-26, citing a rebound in private consumption, resilient corporate and bank balance sheets, and continued government capital expenditure. The central bank expects the Indian economy to remain the fastest growing major economy globally.

Inflation projections for FY2025-26 have been revised downward to 3.7%, thanks to easing supply chain bottlenecks, falling global commodity prices, and expectations of an above-normal monsoon boosting agricultural output.

Key Highlights from RBI June 2025 Policy

- Repo Rate: Reduced by 50 bps to 5.50%

- CRR: Reduced by 100 bps to 3%, releasing ₹2.5 lakh crore liquidity

- CPI Inflation (FY26): Projected at 3.7%

- GDP Growth (FY26): Maintained at 6.5%

- Policy Stance: Shifted from ‘Accommodative’ to ‘Neutral’

With inflation under control, the RBI has chosen to stimulate the economy through aggressive rate cuts. While this offers relief to borrowers and supports investment sentiment, savers may need to explore alternative investment options to maintain real returns.

Stay tuned to our platform for more updates and expert analysis on what these changes mean for your portfolio.

Source: The Indian Express